Full Service Payroll

Error-free payroll processing.

You enter hours. Intuit does the rest.

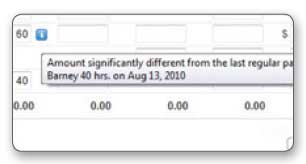

Instant online alerts when you enter hours significantly different than usual hours.

How It Works

❶ Intuit sets up your account

- We transfer prior payroll information

- We verify employee and company information

- We set up direct deposit accounts

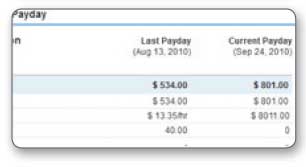

Smart technology allows you to compare your total payroll to your last payroll. This allows you to double check your payroll before moving forward.

- You enter hours and preview payroll

- Instant alerts if errors are detected such as hours significantly different from usual

- You can even compare with previous periods

Preview of your payroll before the final submission – before any money is moved.

- We process payrolls weekly, bi-weekly,semi-monthly, or monthly

- We notify you about upcoming taxes and forms

- We create and distribute W2s at year end

Intuit’s Guarantee

Each payroll you submit is actively reviewed for accuracy by our experts. Your paychecks and payroll taxes are guaranteed error-free or the next month is free.

* Estimate based on 12/10 fifteen-state comparison of Intuit Full Service Payroll vs. ADP Essential Payroll for 5 employee business running payroll bi-weekly. Prices may vary by state and number of employees.

Save Money with 5 Employees!

Save more than 15% on average per month and $250 or more per year by choosing Intuit Full Service Payroll vs. ADP*